THE AMS GUIDE TO BEST PRACTICES

EVENT PERFORMANCE

We differentiate between a measure and a metric. The measures that follow do not contain or require any calculations. They are simply a measure of some distinct, easily quantifiable data point. Metrics, on the other hand, are calculated values typically represented by a fraction of two measurable dimensions.

Standard measures represent essential functional awareness of the organization’s activity. They are frequently used as elements in metric calculations, and, while not metrics on their own, often yield insights when visualized over time.

- Events

- Number of ticketed events

- Number of non-ticket events

- Presenter type

- Center presentation

- Resident company

- Non-profit rental

- Commercial rental

- Discipline (see mapping documentation)

- Classical music

- Dance

- Opera

- Theater

- Education & Family

- Variety

- Film

- Popular music

- Lecture

- Comedy

- Community-based

- Number of attendees per event

- Venue utilization measures

- Performance days

- Non-performance days

- Rehearsal days

- Tech days

- Dark days

- Ticket transaction measures

- Number of tickets sold

- By discipline/presenter

- By sales channel

- Subscription vs. Single-ticket purchase

- Box Office

- Phone

- Group sales

- Outlet

- Internet

- Other

- Subscription vs. Single-ticket purchase

- Number of comps

- Drop count (actual attendance)

- Number of tickets sold

ORGANIZATION ACTIVITY

No metric viewed in isolation can be the basis for understanding overall organizational health. However, when used in conjunction with each other, these metrics help to form a composite story of the organization’s overall health as it relates to activity, financial performance and ultimately, achievement of mission and purpose. PAC leaders should consider adopting these metrics to meet individualized organizational needs and answer the questions most relevant to their stakeholders.

The following metrics represent those utilized in best practice by many of the largest and most successful performing arts centers in the world. We have divided the list between “standard” metrics designed to track simple baselines for the organization and “best practice” metrics which are formulated to offer a granular view of many different areas of performance the PAC should consider monitoring and including in their strategic planning efforts.

- Total Revenue per Patron

- Description: When used in conjunction with other metrics, this can help organization leaders ascertain how closely their financials represent an expression of their organization’s mission and purpose.

- Calculation: (Total operating revenue)/(Total patrons)

- Revenue per Event

- Description: When used in conjunction with other metrics, this can help organization leaders understand the impact of utilization on overall financial results. Calculation includes all event types, even those described as non-ticketed or non-performance (or both).

- Calculation: (Total operating revenue)/(Total number of events)

- Occupancy Cost per Square Foot

- Description: This metric is useful in tracking fixed costs relative to venue footprint.

- Calculation: (Occupancy cost)/(Square footage)

- Marketing Cost per Patron

- Description: The overall marketing outlay per patron is useful for tracking relative marketing spend over time.

- Calculation: (Marketing expenses)/(Total patrons)

- Marketing Cost as a percentage of Programming Revenue

- Description: This is designed to help the marketing department in the budget process. Time-based data can help forecast greater or reduced need for market spend.

- Calculation: (Marketing expenses)/(Programming revenue)

- Occupancy Cost per Seat

- Description: This is useful in tracking fixed costs relative to the amount of space dedicated to stage-based revenue generation.

- Calculation: (Occupancy cost)/(Total seats)

- Occupancy Cost per Patron

- Description: This is useful in tracking fixed costs as they pertain to wear and tear of facility over time.

- Calculation: (Occupancy cost)/(Total patrons)

- Occupancy Cost per EventDescription: This is useful in tracking fixed costs as they pertain to wear and tear of facility over time. Designed to work in conjunction with Occupancy Cost per Patron.Calculation: (Occupancy cost)/(Total number of events)

- Programming Revenue per Programming ExpenseDescription: Also referred to as “programming yield,” this metric helps measure the revenue generated by one dollar of programming investment (exclusive of other organizational fixed expenses).Calculation: (Programming revenue)/(Programming expenses)

- Programming Expense per PatronDescription: This is useful to understand trends in outlay for ticketed activity.Calculation: (Programming expenses)/(Total patrons)

- Programming Revenue per Available Seat (RevPAS)Description: This is useful to understand trends in ticketed-based revenues relative to a fixed inventory.Calculation: (Programming revenue)/(Total available seats)

- Total Revenue per Available Seat (TRevPAS)Description: This is useful to understand trends in overall revenues relative to a fixed inventory.Calculation: (Total operating revenue)/(Total available seats)

- Fundraising YieldDescription: This metric measures the return on one dollar spent to raise unearned revenue. Useful in tracking Advancement efficiency over time.Calculation: (Total fundraising cost)/(Contributed revenue,excluding government support)

INSTITUTIONAL FINANCIAL HEALTH

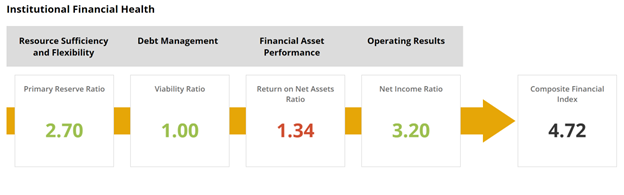

This specialized group of metrics helps to assess overall financial health and is based on a set of ratios which, after properly weighting and scoring, can create a single score known as the Composite Financial Index (CFI)[1]. CFI is useful in helping boards and other key stakeholders with little or no knowledge of PAC financials understand the financial position that the institution holds in the marketplace. The metric also proves valuable in assessing the prospects of the PAC and functions as an “affordability index” of a strategic plan.

CFI is established first by creating the values of the four core ratios:

- Primary Reserve Ratio

- Net Income Ratio

- Return on Net Assets Ratio

- Viability Ratio

These ratios compare the institution’s operating commitments (Primary Reserve Ratio) and its outstanding long-term obligations (Viability Ratio) against its expendable wealth. They measure the ability of the organization on a short-term basis to live within its means (Net Income Ratio) and the ability of the PAC to generate overall return against all net resources (Return on Net Assets Ratio).

The core ratios were selected because they represent the measurement of key components in relation to institutional risk that must be consistently addressed. As an example, outstanding debt, by itself, is not a particularly informative number. But within the context of usable retained wealth, the relative debt level becomes informative, allowing an understanding of the institution’s capital structure and the affordability of its debt. Expendable net assets provide insight into whether the organization’s operating size is reasonable within the context of usable retained wealth. The return that the institution has been able to achieve, both in terms of current operating size and in terms of total wealth, for which the board has fiduciary responsibility is a key indicator of overall financial performance.

This set of metrics highlights two basic concepts that run throughout our approach to analysis. First, that a few measures can effectively provide insight into financial health; and second, that the ratios are most useful if the information is readily obtainable and the calculations repeatable. Note that the ratios deal only with the financial aspects of the PAC and must be blended with KPIs in other areas such as activity and utilization to understand a more complete measure of institutional strength.

This ratio measures financial strength of the PAC by comparing expendable net assets to total expenses. The ratio represents a snapshot of financial strength and flexibility by indicating how long the PAC could function using its expendable reserves without relying on additional net assets generated by operations. The ratio also serves as a counterpoint to the Viability Ratio.

Answers the question: Are resources sufficient and flexible enough to support the mission?

Calculated as follows:

- Expendable Net Assets

- Total Expenses

A large surplus or deficit directly impacts the amount of funds a PAC adds to or subtracts from net assets, thereby affecting the Primary Reserve Ratio, Return on Net Assets Ratio and the Viability Ratio.

Answers the question: Do operating results indicate the institution is living within available resources?

Calculated as follows:

- Change in Unresetriced Net Assets

- Total Unrestricted Income

This ratio determines whether the PAC is financially better off than in previous years by measuring total economic return. A decline in this ratio may be appropriate and even warranted if it reflects a strategy to better fulfill the PAC’s mission. Like all the other ratios, this one is better applied over an extended period so that the results of long-term plans are measured.

Answers the question: Does asset performance and management support the strategic direction?

Calculated as follows:

- Change in Net Assets

- Total Net Assets

This ratio measures one of the most basic determinants of clear financial health: the availability of expendable net assets to cover debt should the PAC need to settle its obligations as of the balance sheet date.

Answers the question: Are debt resources managed strategically to advance the mission?

Calculated as follows

- Expendable Net Assets

- Long term debt

Assessing the organization’s financial health and financial risk is a critical step in developing strategies and effectively managing institutional risks. Using a single financial metric for financial health that offers a more holistic approach to understanding the total financial health of the institution may assist in this process. After understanding the relative strengths and weaknesses of each of the four core ratios, it is useful for the PAC to be able to combine them into a single score. This combination, using a reasonable weighting schema, allows a weakness or strength in a specific ratio to be offset by another ratio result, thereby allowing a more holistic approach to understanding the institution’s total financial health.

One important process in institution risk management is to determine risk capacity. Although there is no one overall quantitative measure of risk capacity, and its assessment must include qualitative factors such as ability of management, there are several financial aspects that must be considered. These include liquidity, debt capacity, expendable net assets and financial condition.

The CFI can assist in the financial analysis component of strategy setting and risk management and is beginning to be useful in helping PAC boards and senior management understand the financial position their institutions enjoy in the marketplace. The CFI should also prove valuable in assessing future prospects, functioning as an “affordability index” of a strategic plan.

The four-step methodology[2] for calculating the CFI is as follows:

- Values of four core ratios are computed.

- These values are converted to strength factors along a common scale.

- Strength factors are then multiplied by specific weighting factors.

- The resulting four numbers are totaled to reach the single CFI score.

Using the CFI in strategy plan goal-setting and financial modeling will aid PACs in communicating overall financial health instead of using numerous financial metrics. Reporting the CFI over time, presented with narrative discussion of the PAC’s financial drivers, such as increased attendance driven by a blockbuster season, or new debt to finance capital projects, and staff headcount, will effectively communicate the institution’s financial health. While CFI was not initially designed for peer group comparison due to the flexibility in calculating the component ratios, we have adopted PAC-specific calculations that lend the ratios to reasonable comparison.

The CFI only measures the financial component of an institution’s well-being. It must be analyzed in context with other activity to achieve an assessment of overall health. Many of the metrics recommended in this manual will serve as indexes of other non-financial activity inside the PAC and may be combined in the narrative with CFI to create a holistic picture of the organization’s overall health.

As an example, if two organizations have identical CFI scores, but one requires substantial investment to meet its mission-critical goals, and the other has already made those investments, the first institution is less healthy than the second. In fact, a high CFI is not necessarily indicative of a successful institution although a low CFI generally is indicative of additional challenges. When considered in the context of achievement of mission, a very high CFI with little achievement of mission may indicate a failing institution.

[1] CFI was developed and introduced by Prager, McCarthy and Sealy in conjunction with KPMG to help institutions in higher education. AMS Analytics has adopted the approach for use in performing arts center management.

[2] For strength and weighting tables as well as a worksheet to calculate CFI, please contact Jordan Gross-Richmond, Director of AMS Analytics.